34+ How much will a bank lend mortgage

Most lenders base their home loan qualification on both your total monthly gross income and your monthly expenses. LVR is calculated by comparing how much is being borrowed against the total value of the property.

Artisans Bank Small Business Loan Ads Small Business Loans Business Loans Business

When you apply for a mortgage lenders calculate how much theyll lend based on both your income.

. Now is the Time to Take Action and Lock your Rate. Ad Were Americas 1 Online Lender. Lock Your Rate Now With Quicken Loans.

New lending rules rolled out in January 2014. In this Mortgage Minute we check out what banks look at when considering how much they can lend you. Your Guide To 2015 US.

In Singapore the LTV limit depends on your home type and the number of outstanding mortgages. Lock Your Rate Now With Quicken Loans. With an interest only mortgage.

Bank Has Loan Officers To Personally Guide You Through the Home Mortgage Process. Ad See If You Qualify For Reverse Mortgage Loans. Apply Online Get Pre-Approved Today.

Minimum FHA Credit Score Requirement Falls 60 Points October 11. So in simplistic terms if the property is worth 500000 and you have a 400000. We calculate this based on a simple income multiple but in reality its much more complex.

Compare Top Lenders Today. Ad Learn More About Mortgage Preapproval. Save Time Money.

Ifthe deposit is 40000 for the. Ad Use Our Comparison Site Find Out Which Mortgage Lender Suits You The Best. Enjoy A Stress-free Retirement And Save Using LendingTree.

Fill in the entry fields. Fatima earns 35000 a year and is committed to paying 200 each month towards her car finance loan. There are two main factors that are taken into consideration to determine how much of a mortgage payment you can handle.

These are your monthly income usually salary and your. This is a percentage that shows the split between your mortgage and the loan amount after youve paid your. Compare Best Mortgage Lenders 2022.

Ad It Only Takes 3 Minutes To Get a Rate 25 Days To Close a Loan. If someone has a deposit of 100000 to buy a 200000 home then the loan to value LTV rate is 50. This mortgage calculator will show how much you can afford.

Browse Information at NerdWallet. So the debt-to-income ratio is a decent indicator of how much a mortgage lender might lend you based on your current financial situation. First things first they will look at deposit size and this impacts how.

Mortgage lenders will consider your loan-to-value ratio LTV the amount youre borrowing compared to the overall cost of the loan. But it also means the crucial loan-to-value rate is lower. Ad Were Americas 1 Online Lender.

Homeowner Tax Deductions. With a capital and interest option you pay off the loan as well as the interest on it. Typically the higher your deposit the lower your LTV.

Lender Mortgage Rates Have Been At Historic Lows. Using the calculator they found that Woolwich from Barclays will. A general rule is that these items should not exceed 28 of the borrowers gross income.

The majority of lenders demand that you will spend less than 28 percent of your income before taxes on housing and that you will spend no more than 36 percent of your. Now is the Time to Take Action and Lock your Rate. A big part of the mortgage application is your loan to value ratio or LTV.

However some lenders allow the borrower to exceed 30 and some even allow 40. The mortgage should be fully paid off by the end of the full mortgage term. Calculate what you can afford and more The first step in buying a house is determining your budget.

How Much Can I Borrow Calculator MoneySuperMarket Mortgage calculator Find out how much you could borrow Banks and building societies mostly use your income to decide how much. These monthly expenses include property taxes PMI association. Ad Competitive Rates Online Conveniences - Start To Apply Online.

Take Advantage And Lock In A Great Rate. Get Instantly Matched With Your Ideal Mortgage Lender.

Pin On Financial Services

26 Great Loan Agreement Template Contract Template Loan Best Loans

Mortgage Application Checklist Mortgage Pre Approval Real Estate Buyer Tips Editable Loan Officer Template Home Loans Realtor Flyer

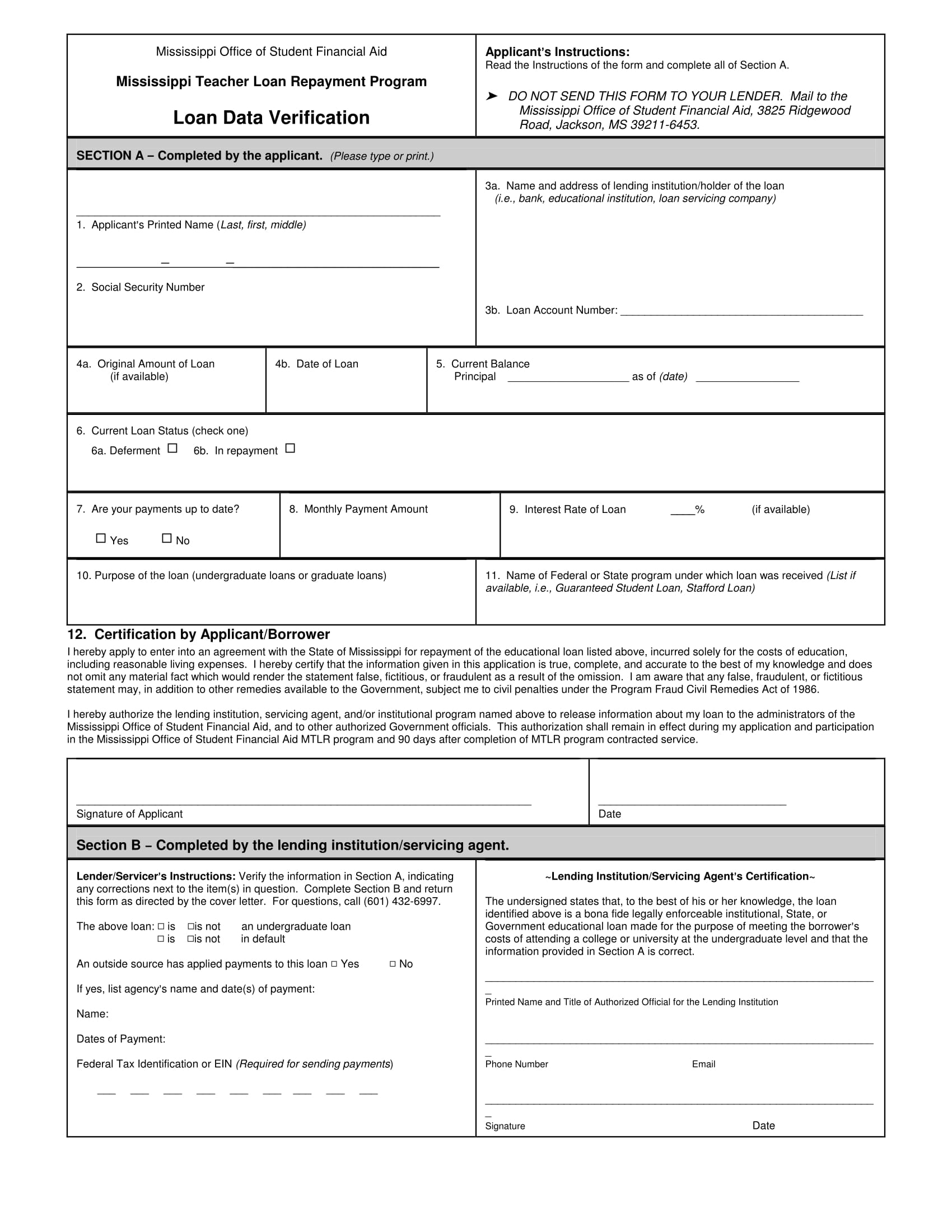

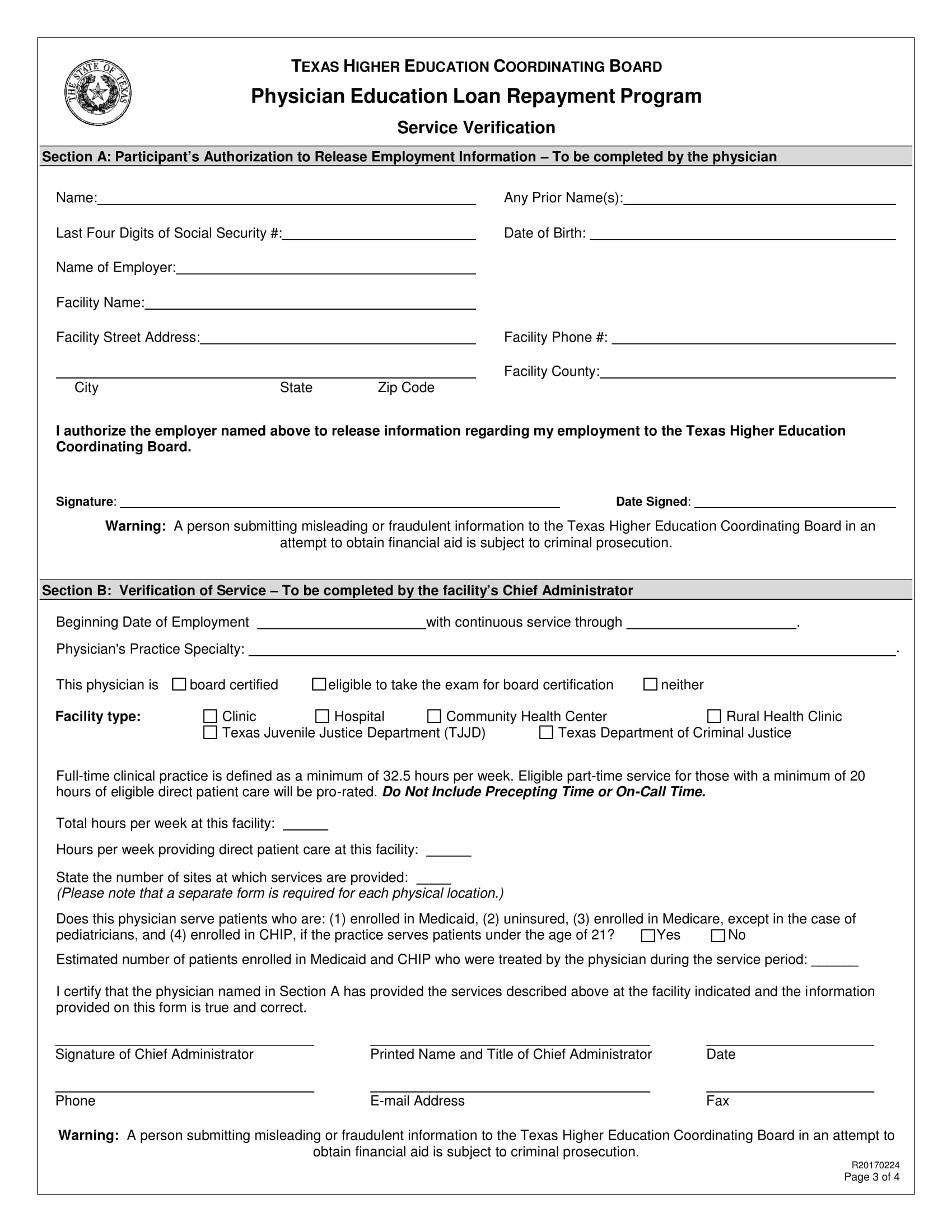

What Is A Loan Verification Purpose Uses

List Of Documents For A Mortgage Loan Getting Into Real Estate Real Estate Terms Home Buying Tips

Tumblr Home Equity Loan Calculator Mortgage Amortization Calculator Mortgage Payment Calculator

Mortgage Broker Vs Big Bank Who Should I Choose Mortgage Brokers Refinance Mortgage Mortgage Tips

What Is A Loan Verification Purpose Uses

Free 5 Sample Mortgage Commitment Letter Templates In Pdf Ms Word

Free Printable Bank Loan Agreement Legal Forms Mortgage Brokers Legal Forms Proposal Templates

Free 5 Sample Mortgage Commitment Letter Templates In Pdf Ms Word

Mortgage Burning Cake Edible Bank Note Mortgage Payoff Mortgage Lenders Mortgage Loans

Feeling That Homeowner Fomo Here Are Some Tips On How To Get Started With The Home Buying Process Home Buying Process Home Buying Home Financing

Best Passive Income Sources From Loans 2022 Mortgage Auto Loan Personal Loan Bank Statement Pdf In 2022 Bank Statement Personal Financial Planning Statement Template

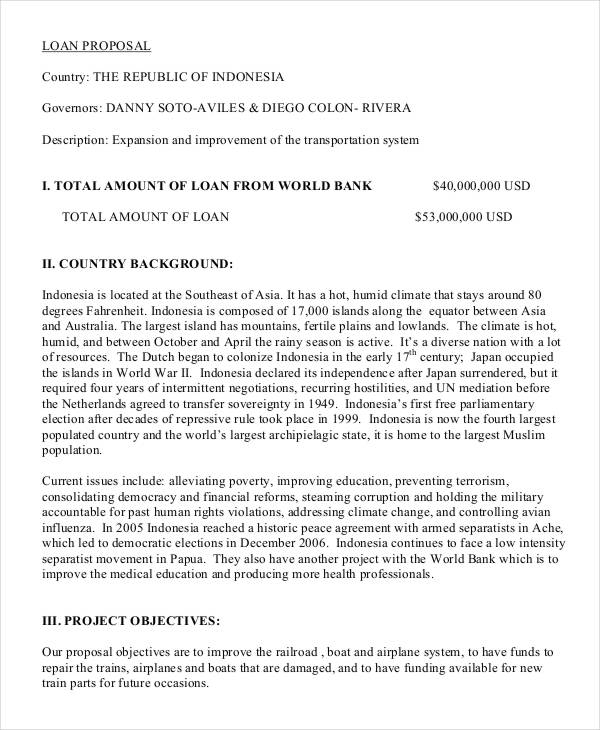

6 Loan Proposal Templates In Pdf Ms Word Pages Google Docs Free Premium Templates

Loan Against Property Union Bank Of India Mortgage Loan Mortgage Loa Union Bank Mortgage Loans Mortgage

Pin By Akbanknotes On Loan Applications Mortgage Process Mortgage Loan Originator Mortgage Loans